As I went through Gurufocus 52 week lows list LeapFrog popped up on the list. The company is selling below book value and net current asset. LeapFrog is currently a classic Benjamin Graham net net play. The market is currently value LeapFrog for less then cash and net working capital. Mr. Market have given us value investors an rare net net opportunity with an margin of safety of 30%.

Company Overview

LeapFrog Enterprises (LF) is a educational entertainment company that designs, develops, and markets technology-based learning products for children. The company has a strong well recognized brand power,as well as strong commercial and sales distribution relationships. LeapFrog has created several well-regarded products that parents trust to educate their children with. Despite LeapFrog's strong brand name the firm stock fell 41% during 2014 and had light demand for its educational products. The company goes through cycles where its is quite profitable and other years like 2014 where its makes no money. LeapFrog lost the bulk of its market value last year, and the market is currently valuing the company at less then its cash and net working capital. Since the company earnings, revenues,and sells go through a cycle so does the markets value of the firm. This creates an opportunity for rational investors to buy stake in LeapFrog for less then net current asset value.

Business Overview

LeapFrog has been a pioneer in making reading and learning fun with its devices that has been very popular with the market. Until recently with the introduction of cheaper kid friendly versions of the kindle and samsung tablets has taken a toll on the company's sales. In 2011 the company introduced the LeapPad which sold out during the 2011 holiday season and in 2012 introduced an updated version of the LeapPad sold just as well. But now with cheaper kid friendly devices on the market LeapFrop has seen its sales fall and earning fall as a result of stiffer competition.

New Devices

Leapfrog a few months ago entered the fitness tracker market with its LeapBand that sells for $40. The LeapBand encourage kids to move with 50 different movement challenges. LeapFrog through its wearable LeapBand is targeting kids between the ages of four and seven with parents that use Fitbit, Jawbone, UP, and other wearable movement-tracking bands. The company's other big products is the LeapTV, which is the firm biggest play into the gaming console market. Its new LeapTV console that encourages fitness with its motion-based controller. At a $150 price tag makes its console is cheaper than traditional next-generation console. LeapTV games cost about half of its competitors games do. The company is clearly not putting all of its eggs in its new product line and is continuing to update LeapPad and other legacy learning toys.

LeapFrog's Product Portfolio

- LeapTV - A TV video game console that uses motion control.

- LeapBand - A wearable tracking risk band for four through seven year olds.

- LeapReader - A specially designed stylus that reads audoi books aloud and teaches basic writing skills.

- LeapPad - Is a personalized learning tablet designed for childern ages fouth to nine.

Smartphone Apps

LeapFrog has developed educactional smartphoen applications that includes;

- Scout's ABC Garden App - iPhone, iPod Touch, and iPad application that was released in 2011.

- Creativity Camera - An iPhone and iPod app tha was released in 2011.

- Mr. Pencil: Learn To Write - An iPhone, iPod and iPad app that was released in 2013.

LeapFrogs Licensing and Partnerships

The company licenses its its LeapFrog Learning Friends to third parties and partners with various companies.

- Kiddieland limited produced ride on toys.

- Masterpieces Puzzles produces jgsaw puzzles.

- Learning Horizons produces books and various stationeries.

Various Partnerships

- Sega toys and Benesse produces localized versions of the toys for the Japanese market.

- Macromedia to co-develop the Leapster handheld gaming console.

- Liongate Home Entertainment has produced LeapFrog learning DVDs.

Financials

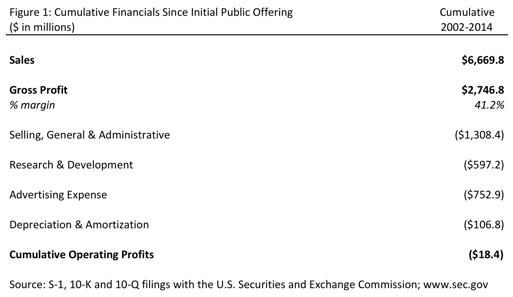

Over the last 13 years has generated $6 billion of revenues and over $2.6 billion in profits as well. In some years Since going public LeapFrog has spent over $1.3 billion on Sells, General & Overhead. Leapfrog is profitable and generates double digit margins similar to its peers. Leapfrog is very capable of generating a large amount of revenues and gross profits, but its very cyclical since the company has little product diversification. The company operates with lower gross margins then its competitors. Leapfrog spent $1.3 billion over 13 years on advertising and R&D to build its products and brand. Clearly the company is suffering from the lack of diversification and manufacturing scale. This lack of diversification and scale have lower margins then its competitors. For the nine months ending in December 2014, the firm reported revenues of $305 million and a net loss of $142 million. Leapfrog has during the first of half of fiscal year 2015 reported back to back quarterly losses. The company has seen a 43% decline over the prior year in net sales.

Valuation

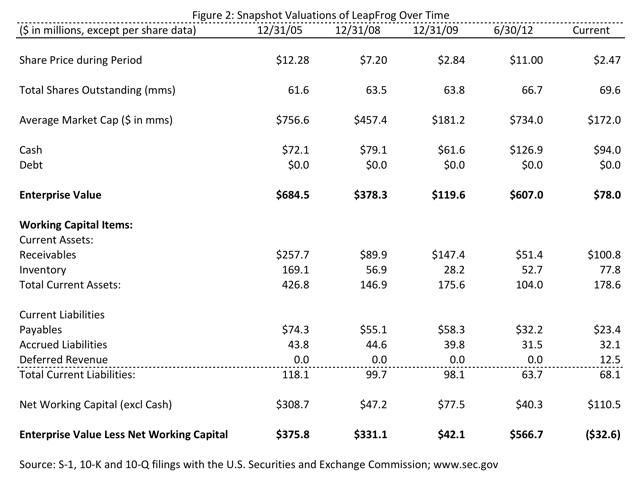

LeapFrog is currently selling for less then cash and net working capital. The market has sent the company shares tanking to the point that LeapFrog is now a classic Benjamin Graham play. The company is selling for -4x its earnings and 0.6x its book value. LeapFrog has a net current asset value of $3.5 per share and has a tangible book value of $3.96 per share. The company is selling for 0.65x its net current asset and has a current ratio of 4.0x. LeapFrog is facing stiff competitions from its competitors and has little to no diversification with its products. The company is selling for at least a 30% discount to NCAV giving any rational investor a margin of safety of at least 30%. With a 30% margin of safety with little to no risk of losing your capital since the company is selling below liquidation value. If the company liquidated shareholders would receive at least $3.00 a share at its current price is at least a 25% return on your investment. Market has created great opportunity to buy a NCAV with a 30% margin of safety since the LeapFrog should sell for atleast NCAV per share.

No comments:

Post a Comment